Besides your legal obligations as a PCBU, running a business comes with inherent risks: An employee could get injured on the job; a natural disaster could destroy property; or a client could file suit, alleging a contractual breach. For those and other reasons, it is important to protect your assets, both business and personal. One of the best ways to do that is to make sure you and your business are adequately insured. As a service station operator, there are several types of insurances which you may obtain to protect your business, in Metro Petroleum we would like to make sure you always have a valid policy of four most important types of insurances include:

- Workers Compensation

- Public Liability

- Business Insurance

- Building insurance

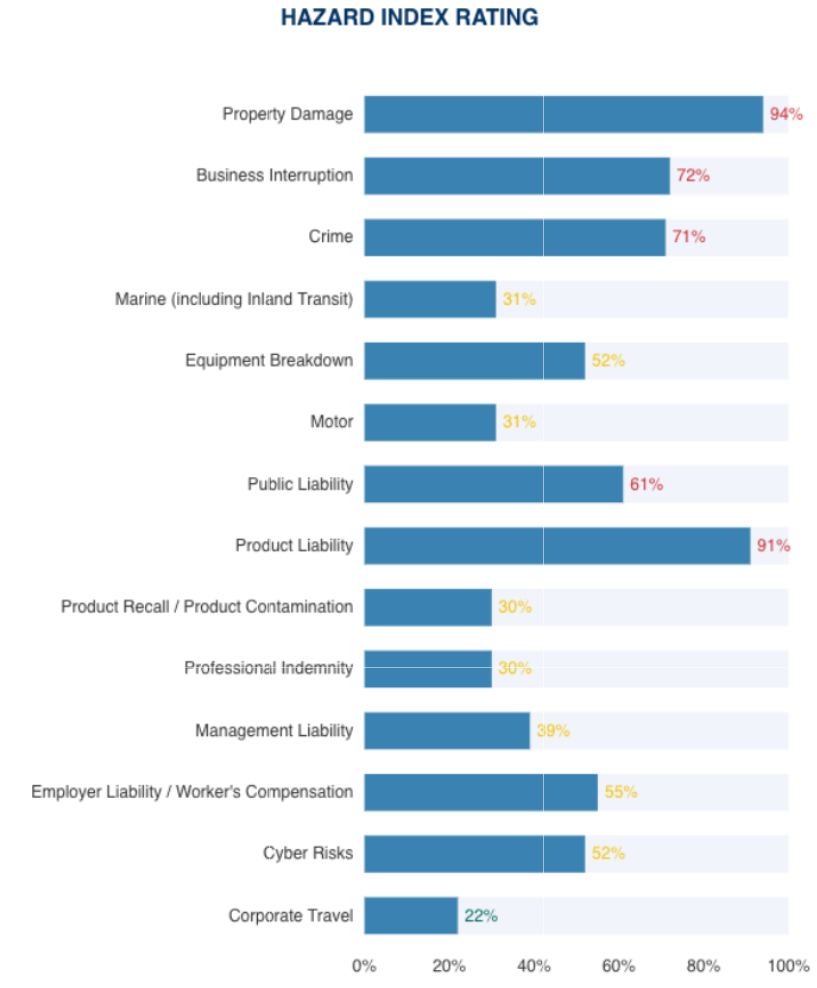

As per LMI RiskCoach report identifying hazards in the workplace involves finding things and situations that could potentially cause harm to the organisation. The following chart is a graphical representation or the likelihood and severity of a loss occurring within any of the classes of insurance listed in the chart.

Service Stations are among most riskest businesses, in below you can see some of the significant exposures for business.

- 24-hour operations

- Business Interruption – Availability of a suitable premise to relocate to after a loss temporary or permanent

- Business Interruption – Facility reconstruction could be delayed by the need for council/local authority approvals

- Contaminated or incorrect fuel

- EPA Issues (tank leak, spillage etc;)

- Explosion Fidelity losses

- Lead time on replacement of equipment and installation

- Loss of Data

- Slip and falls

- Smoking hazards/flammable substances

- Unattended operations

- Underground storage tanks

What is Workers Compensation Insurance?

Workers compensation is a form of insurance payment to employees if they are injured at work or become sick due to their work.

Workers compensation includes payments to employees to cover their:

- wages while they’re not fit for work

- medical expenses and rehabilitation.

Employers in each state or territory have to take out workers compensation insurance to cover themselves and their employees.

What is Public liability insurance?

Public liability insurance covers your business for losses or damage to a third party as a result of your business’ activities. Failure in obtaining public liability insurance policy can expose a business to a range of risks.As a business, you will inevitably have interactions with customers and third parties that will pass through the premises or use a good or service you sell. From occupational health and safety to Australian Consumer Law, businesses are responsible for ensuring the safety of third parties that engage with the business.

What is Business Insurance?

Service Stations have their own, unique, insurance needs. They are a critical resource for motorists, and literal lifeblood of Australia’s logistics and transportation industries, but they are also high-risk businesses that need to protect themselves against everything from theft to a fire, which, for obvious reasons, could cause catastrophic damages.

In addition to the standard covers offered by other insurers ie. Fire, Burglary, Money, Business Interruption, Glass, Liability Engineering etc. some provider also includes the following additional benefits:

- Accidental damage

- 100% increase on money cover for weekends and long-weekends

- Reduced rate for cigarettes kept in locked safe

- Personal accident at no additional cost for the principal working director

How to enter your insurance information on MyServo platform

Click here to login to MyServo profile >> Service Station >> Section 7 – License / Notification and enter your policy number, insurance provider and expiry date. MyServo will automatically inform you one month, two weeks and one day before your insurance expiry date to make sure you always have a valid policy.

We highly recommend uploading your Workers Compensation insurance to your profile to have it available for auditors.